The truth is that as a wearable item, gold jewelry often does not appreciate in value like coins, bullion or bars. Instead, jewelry tends to hold its value over time, unless you have a rare piece of jewelry with historical or celebrity significance. However, your great-grandmother’s ring with a large opal setting may have more sentimental than monetary value.

Nevertheless, investing in gold jewelry can be a good investment for knowledgeable jewelry buyers. If you’re willing to invest the time and energy to have your jewelry appraised, and if you enjoy wearing your pieces as a collector while you wait for the right-buyer to recoup your investment gold jewelry can be an excellent long-term investment for your portfolio.

What are the benefits of investing in gold jewelry

Investing in gold jewelry has some advantages over other types of investment. While the stock market fluctuates from day to day, the price of gold tends to rise and fall with greater predictability.

A balanced portfolio of gold investments that includes gold jewelry can protect your portfolio from market volatility. The valuation of gold jewelry compared to other gold investments is different enough that you can take advantage of factors other than the price of gold when trying to sell your gold jewelry.

For example, because gold is extremely soft and easily damaged, most jewelry isn’t made from pure gold. Instead, jewelers mix in stronger metals to create gold alloys, which are measured in carats. Jewelry also comes in different shapes and degrees of workmanship. A solid gold band ring may contain more gold than a finely woven chain necklace, but the necklace requires a greater degree of skill to make.

Other benefits of adding gold jewelry to your investment portfolio include:

- The popularity of gold jewelry with certain fashion collectors who are willing to pay more for rare pieces

- A global market for gold jewelry and high demand for popular styles or those with inlaid precious stones

- Resistance to tarnishing and the ease of cleaning any tainted jewelry

- The ability to wear your investment to show off your gold jewelry collection

Many wealthy investors in countries such as China and India collect gold jewelry ranging from vintage and antique collectors’ items such as brooches necklaces and tennis bracelets to trendy celebrity jewelry such as heavy gold chains, bulky rings, delicate belly chains and grills (decorative tooth jewelry).

Are there any risks associated with investing in gold jewelry

Unless you are trying to find a buyer who is specifically interested in collecting gold jewelry, it is likely that you won’t be able to resell your gold jewelry for much more than what you paid for it in the first place. Other potential risks to invest in gold jewelry include:

- Providing adequate physical storage for your gold jewelry when not in use

- Not generating passive income like other investments, such as stock dividends or property rental income

- Niche investors may be hard to find if you want to sell your gold jewelry.

- Factors affecting the value of gold jewelry

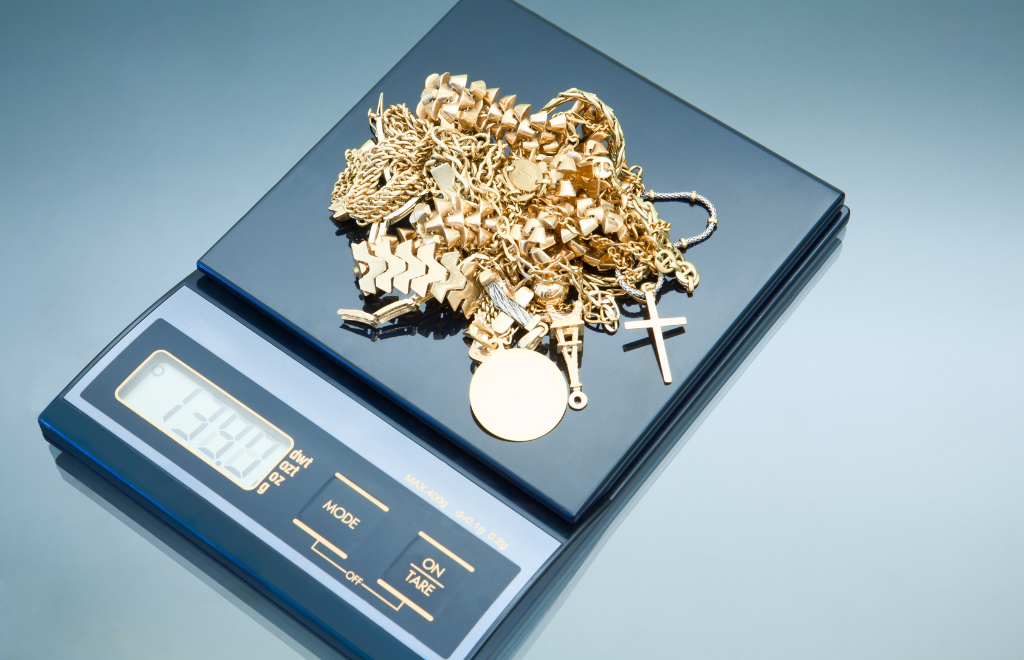

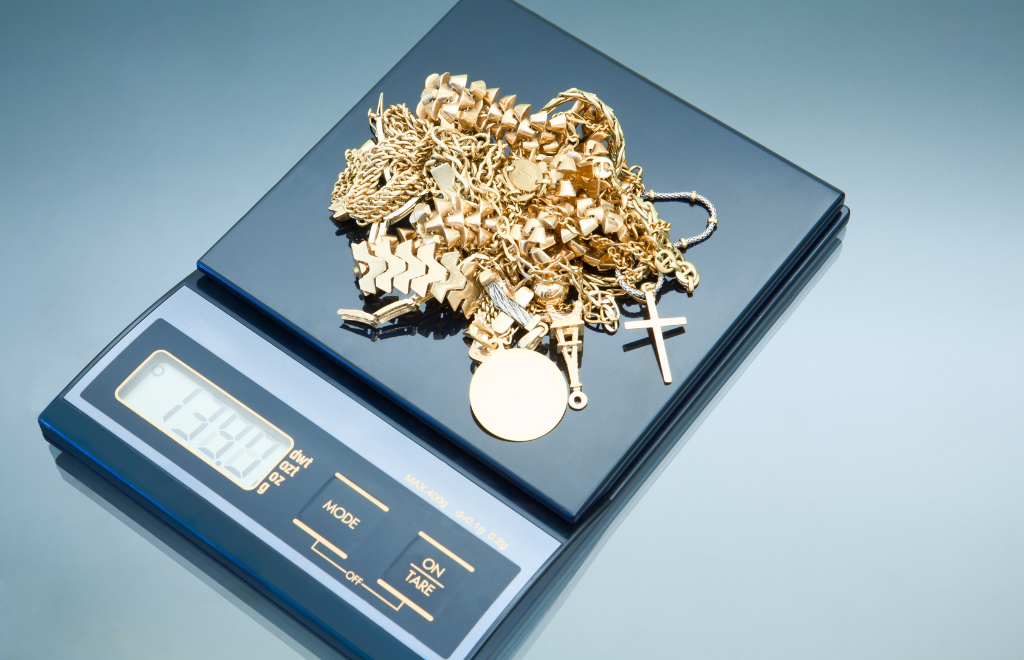

Jeweler weighing gold jewelry to check price

The price of gold and the amount of gold in a piece of jewelry aren’t the only factors that matter when trying to sell your gold jewelry. Unlike bullion, coins or bars, each piece of jewelry in your collection has a specific intrinsic value.

So what is most important when valuing your gold jewelry collection? That depends on how you intend to sell it. You can sell it to a pawnbroker or jeweler based on its weight, purity and the value of any gems in the piece. You could also wait for another interested jewelry collector to buy it, or trade it on a second-hand market.

You may find that demand for certain pieces is higher at different times, both in the United States and globally, due to trends, depending on your personal interest in the piece(s) you want to sell. For example, if a hip-hop artist who famously wore a certain style of necklace passes away, any similar jewelry you can sell is likely to increase in value.

But why are these factors important when trying to value your gold jewelry?

Gold purity and weight

One of the main ways people determine how much a piece of jewelry is worth is by calculating the percentage of gold, based on the carat and weight of the piece. For example, 18kt gold contains 75% gold and 25% other metals, usually copper or silver. If you have an 18 karat gold ring that weighs 28 grams, then it would have 21 grams of gold in it.

Many quick sale markets, such as pawn shops or jewelry stores that resell jewelry would make an offer for the value of the gold in the ring and then mark up the purchase price when they resell it to make their profit.

Design, craftsmanship and brand value

You’ll want to have your jewelry appraised and authenticated if you intend to resell it to another collector. The brand, design and overall craftsmanship are more important to collectors than just the gold content. A 60-year-old piece from a long-established brand will be worth more than a mass-produced piece from a newer brand.

Other factors such as whether a piece is handmade or has unique settings, can also increase its value for jewelry collectors who want rare wearable art.

Market demand and trends

Current trends and demand in the gold jewelry market include increased demand for gold in markets around China and India, as well as increased demand for vintage and antique pieces. You may be able to find a buyer online from one of these countries who is willing to pay more for a rare piece of jewelry if you have an older piece.

Tips for investing in gold jewelry

So is gold jewelry a good investment? It can be, if you take the right steps to check the quality of your pieces and make sure you’re buying from a legitimate seller. You also need to understand the potential risks of investing in gold jewelry.

Buy from reputable sellers

Any seller you consider buying gold jewelry from should have good reviews from reputable sources such as Trust pilot. Online jewelry retailers should be listed in the Assay Assured directory of jewelry retailers.

Checking authenticity and quality

Hallmarking and branding involve embossing symbols into the piece of jewelry to indicate the maker, country of origin and purity. Certain brands have a reputation for quality, making pieces from these brands more desirable to collectors.

Consider the purity of the gold

The amount of gold in a piece of jewelry can affect its value. More gold in the piece gives it a higher purity and more value as an investment, but it can also lead to scratches because gold is a soft metal. Flaws can reduce the value of the piece when you decide to sell it, so choosing the right gold alloy for your jewelry investments is a delicate balance.

Assess your risk tolerance

You may want to start your portfolio with coins, bars and bullion if you’re new to investing in precious metals such as gold or silver. These pieces often sell for close to the true value of the metal in the current market. If you’re a more experienced investor who has traded in precious metals before, you may want to consider gradually adding gold jewelry to your investment portfolio.

How does gold jewelry compare with other gold investment options?

The intrinsic and sentimental value of gold jewelry can make it an excellent investment for people looking to expand their precious metal investments and who have a personal interest in collecting gold jewelry. However, if you are looking to invest in gold and silver as a stable and predictable way to grow your investments, gold jewelry may not be an ideal investment.

How does gold jewelry compare with other gold investment options?

The intrinsic and sentimental value of gold jewelry can make it an excellent investment for people who want to grow their precious metal investments and who have a personal interest in collecting gold jewelry. However, if you are looking to invest in gold and silver as a stable and predictable way to grow your investments gold jewelry may not be an ideal investment.

While standardized precious metal investments such as coins, bullion and bars trade close to the current price of gold, gold jewelry has other factors that affect its value. If you don’t know the best market to sell your gold jewelry, you could miss out on high-value resales. However, if you understand the jewelry collector’s market, gold jewelry can be an incredible long-term investment.

Can gold jewelry be a good long-term investment?

If you take the time to do your research, get qualified appraisals for your jewelry buy from a reputable seller, and store your jewelry properly to prevent damage, gold jewelry can be a way to hedge your portfolio against fluctuations in precious metal prices or your stock market investments.